Empower Rental Group Fundamentals Explained

Empower Rental Group Fundamentals Explained

Blog Article

The 7-Minute Rule for Empower Rental Group

Table of ContentsEmpower Rental Group Things To Know Before You Get ThisSome Known Incorrect Statements About Empower Rental Group The smart Trick of Empower Rental Group That Nobody is DiscussingSome Of Empower Rental Group

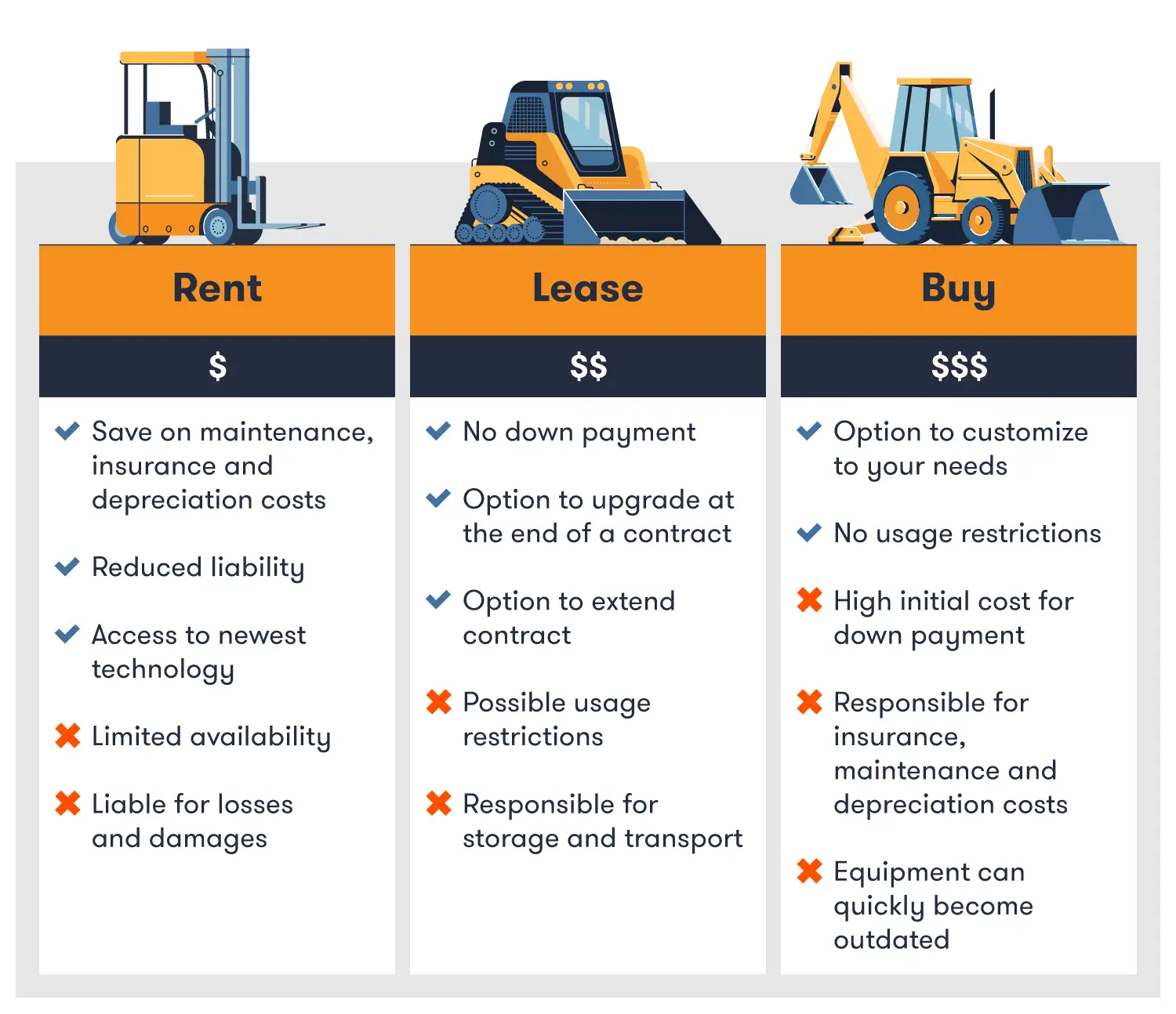

Building business are conserving time and cash by leasing equipment, like forklifts and site cams, more frequently.Firms within all sectors need every one-upmanship they can get. As every person pours over the annual report and all aspects of business to discover benefits, it can actually pay to explore and contrast the costs of renting or leasing tools versus the expenditures of buying and possessing it.

However like any type of various other department or resource, they can and must be structured for maximum performance and flexibility. A cost-benefit evaluation can give valuable information to aid you make an educated choice concerning tools rental versus possession. No matter of just how companies and companies differ in their dimension, objectives and structure, couple of that utilize any size of tools can afford to have it be unwell- matched for the job or sit still and extra.

Empower Rental Group Things To Know Before You Get This

Maybe you head all those departments for your business or perhaps there are different people accountable of each one, however you're likely to draw stats from all for a good evaluation. Holt of California uses an extensive supply of devices for acquisition and rent, so we can aid you decide which alternative finest matches your service needs, whether that be rental, possession or a mix of both.

Along with the quality of Pet cat, Holt of The golden state likewise lugs several various other allied brands. It helps to first take a go back and assess the cost-benefit scenario as relevant to your company (heavy equipment rental). An enlightened, sensible choice will certainly result as you think about all the variables: Estimated rental payments for the duration of use and makers needed Approximate cost of a new device Transportation and storage space expenses Regularity of requirement for equipment Predicted lifetime of brand-new machine Estimated expense of upkeep and service over its life Harsh amount of labor conserved with either alternative Financing choices and offered capital Required for unique innovation or skills with projects or equipment Accessibility of wanted new-purchase devices Possible, multiple uses for equipments both leased or acquired Internal capacity to test, preserve and service makers

One of the most usually suggested numerical benchmark for when it's time to cross over from rental to acquisition is when the tools is required and utilized a minimum of 60-70 percent of the moment. Usually speaking, if you're thinking about need for the equipment in terms of years, that can be an indication that you're approaching acquisition, unless obviously you'll have little or no usage for the device after the present task or set of tasks.

Organizations can utilize some kind of construction-management software application to track vital job data and provide helpful info such as fads or previously unidentified demands. Beyond the difficult numbers rest a bargain of various other considerations, such as safety, quality, performance, conformity, growth, threat, morale, employee retention and other aspects that impact company however do not have a hard number affixed to them.

Fascination About Empower Rental Group

Many industries can profit from renting out equipment instead than acquiring it: Agriculture Automotive Construction Earth moving Government Landscape Logging Military/Defense Mining Pipes Recycling Retail Trucking Waste Companies and individuals rent equipment for a variety of reasons: Conserves money in most cases Caters to short-term devices need Offers specialty efficiency Pleases momentary production increases Loads in when regular makers require maintenance or fall short Helps satisfy target date crunches Broadens maker inventory Boosts overall ability when and where required Removes responsibility of screening, maintenance, service Makes the task schedule easier to take care of with on-demand sources.

The variety of abilities among equipment of all sizes can help organizations offer niche markets and win brand-new and different kinds of projects. Rental options can fill out during an outage or emergency and offer an adaptability that includes logistics and financing, at a minimum. In addition, competition amongst rental suppliers can work to the customer's advantage with prices, specials and solution.

Renting equipment allows you to gain access to trusted tools with a smaller sized initial investment. With less money bound in funding devices, you business will certainly have more funds offered to go after opportunities and keep various other integral parts of business. Any type of item of hefty machinery requires regular upkeep for fault-free operation.

Not known Facts About Empower Rental Group

Mechanics and solution technicians should examine liquids and hydraulics, change worn parts, repair service dripping shutoffs, upgrade innovation the listing goes on. Keeping up with devices upkeep requires control and ongoing expenses.

When you purchase an item of devices, you'll have to establish where to keep it and just how to relocate in between tasks. Your large, heavy building and construction equipment will certainly use up room at your head office, and you'll need a separate vehicle for transportation (https://fliphtml5.com/homepage/atill). Storage and transportation solutions are financial investments themselves, which is why it can be useful to rent out devices rather

When you purchase equipment, you will write off its depreciation every year. Renting out develops a possibility for a larger write-off. You can subtract each rental cost you pay from your service's income an extra regular write-off than what is offered for devices you buy outright. In the same means that the Irs (INTERNAL REVENUE SERVICE) views at rented out devices one means and owned equipment one more means, so do banks.

Report this page